What Inflation Hedge? Instead, Bitcoin Price Tends to Predict CPI Change Since 2020

Bitcoin has regularly been described as an inflation hedge—a place to invest money that would not be affected by inflation. Bitcoin enthusiasts—like hedge fund manager Paul Tudor Jones and Goldman Sachs, which called Bitcoin a “store of value” like gold—promoted this as a trading strategy.

That is, until it was proved wrong as inflation grew alongside bitcoin prices and then fell precipitously in 2021 only a few months after Goldman’s gold proclamation. Anybody investing in bitcoin hoping to avoid the tumult of the dollar would likely have lost money.

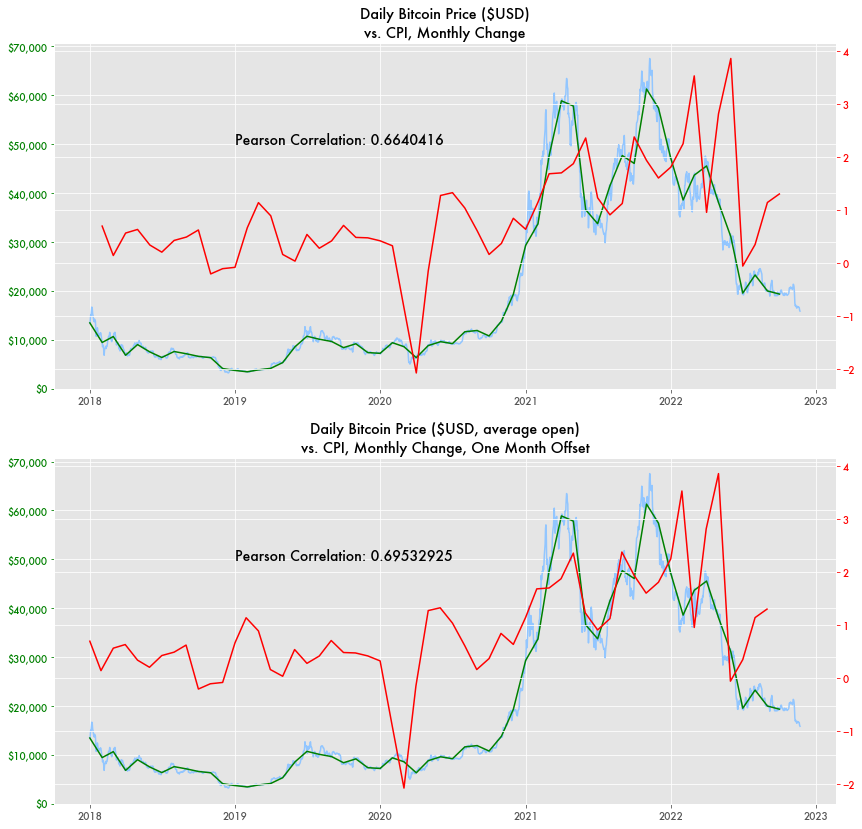

Instead of being independent of the U.S. dollar’s value, Bitcoin prices appear to track inflation by predicting change in the consumer price index (CPI)—the index of consumer good prices that determines inflation.

Beginning in late October of 2020, Bitcoin prices would begin to grow, leading to a bull run on the cryptocoin where its value would increase sixfold in a matter of months. That was also the beginning of the growing inflation that came out of the pandemic following COVID-19 spending by the government.

Bitcoin would begin a large crash in prices at the end of 2021, leading to bankruptcies and contagion across crypto companies. In early 2022, inflation would start ratcheting downward, only a few months after Bitcoin’s decline.

At times, Bitcoin and the change in CPI would map step-by-step with each other just offset by one month, like through most of 2021. Around May of 2021, Bitcoin prices would take a downward swing only to return to where it was in November. A month later, June of 2021, growth in CPI would also swing downward only to return to where it was in October.

Some of that simultaneous growth could be investors jumping into Bitcoin as inflation grew, believing that it would be an inflation hedge. But other times, Bitcoin’s price appears to presage inflation changes by about a month.

Such close correlations weren’t always the case. Sometimes Bitcoin prices increased a lot when CPI grew less and vice versa. Sometimes they were offset by a month, other times it was two months. But in general, they both trended in the same direction. Overall, Pearson correlation for Bitcoin price to CPI change was .66—decently correlated. With a one month offset, it was .70.

Currently CPI growth has been higher than previous months, while Bitcoin prices have slowly fallen below $20,000 per BTC. While those trends appear to diverge, CPI growth is expected to wane in the coming months through 2024, which would show Bitcoin’s prescience.