The Volatile Inflation and Deflation in Consumer Spending

Recent inflation post-pandemic has seen price hikes effectively across the board for all manner of goods.

Previously, inflation was steady. A regular 2 to 3 percent per year. But within each category of consumer goods and services, that wasn’t so much the case.

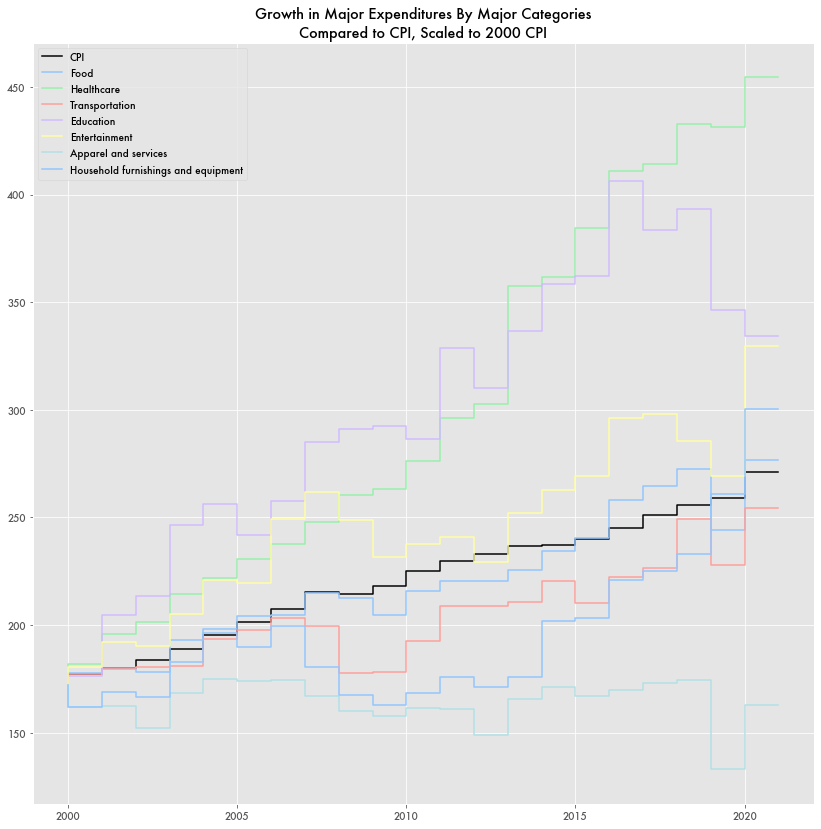

Since 2000, certain categories actually saw large price deflation and others saw inflation far and above the Consumer Price Index (CPI) based on household expenditure data from the Bureau of Labor Statistics (BLS).

Price deflation has been regularly attributed to the wave of cheap imports and changes in purchasing habits via online marketplaces, while overinflation for certain categories is ascribed to policy changes and other trends like higher home values.

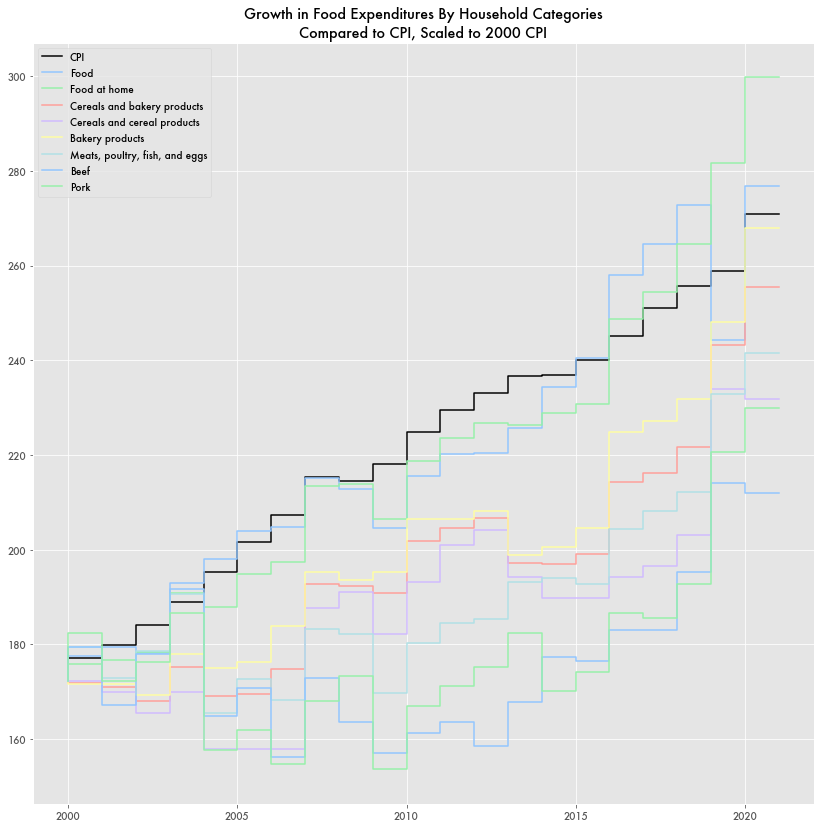

Food Price Deflation

Investigative Economics previously covered how food price inflation had been twice yearly inflation in recent years. But that was because food prices had been seeing substantial deflation since 2000 as competition from cheap imports has exploded. Spending on major commodities like beef, pork, and fruit had all been seeing major declines by 2010.

The recent inflation may simply have been food prices finally catching up. While fruit prices have caught up with inflation, meat prices still lag behind.

Food as well as energy expenditures, like gasoline, are not factored into the CPI which determines inflation as they are considered too volatile. Instead they are included in the Personal Consumptions Expenditures Index (PCE).

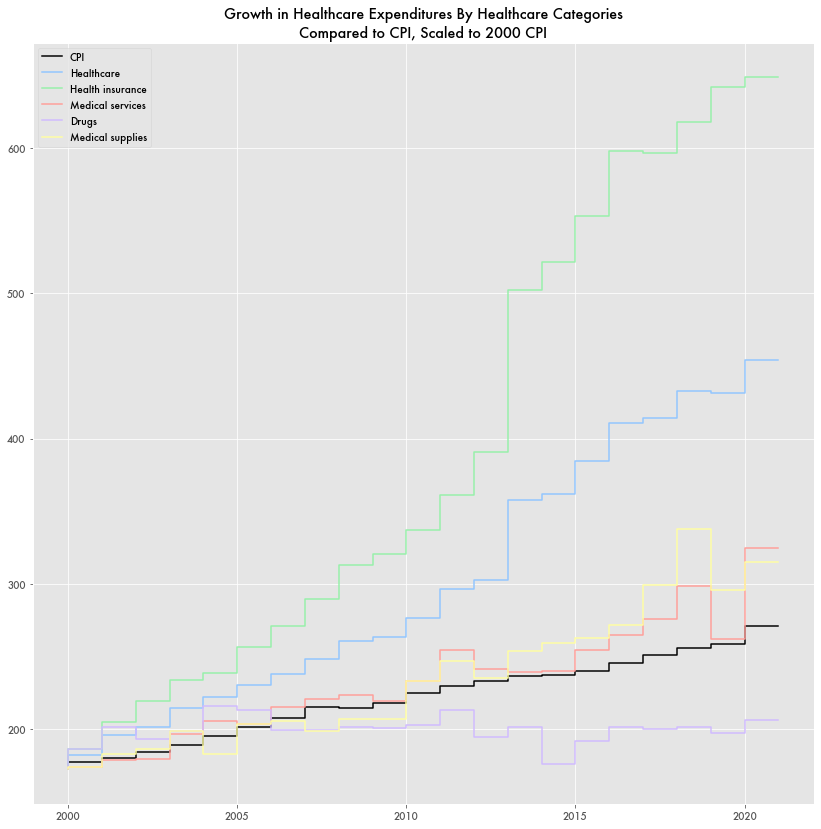

Health Care Inflation Driven By Insurance

Rising health care costs and drug prices have gotten a lot of attention. But much of that may be from their sticker price, not the price paid to end consumers—as opposed to third party purchasers like insurance companies or federal and state government agencies.

A 2018 report from the American Enterprise Institute (AEI) showed medical service costs growing over 200 percent per household. But based on BLS expenditure numbers, growth in expenditures on medical care was slightly above inflation—up 88 percent since 2000 compared to the CPI’s 57 percent—nothing extraordinary. Drug expenditures were significantly below inflation at a measly 19 percent.

But it was health insurance that would grow 277 percent over that time—220 points above inflation—largely since 2012 when Obamacare was passed. Besides the creation of insurance marketplaces, the act implemented an individual mandate that required those without insurance to purchase coverage. The individual mandate has since been rescinded in 2019.

Rental and Property Tax Inflation

While house prices in some areas are much higher than what they were, spending on housing and shelter are in line with inflation and spending on mortgages is actually in decline.

While the average cost of home ownership hasn’t increased substantially according to BLS numbers, it is rental housing and property taxes that are 130 and 117 percent higher respectively.

While home purchase costs are factored into CPI, it’s done as owner-equivalent rent (OER)—the amount a homeowner might rent their house for. Spending on mortgages or other home purchase costs are considered investments and not a core expenditure that would affect inflation.

Car Spending Swings Back Up

Vehicle purchase costs are another one that had seen substantial deflation over the years only to catch up in the last five. Around 2010, spending on car purchases would see a decline of 6 percent. Car insurance would see a 44 percent decline.

In the last four years, car insurance spending is now above inflation and spending on vehicles has closed the gap substantially.

Home Utilities

In general, home utility costs—electricity, gas, etc..—are in line with inflation, but water costs by itself—listed as “water and other services”—grew 135 percent. Over the past two decades a number of cities have revamped their plumbing and water treatment systems to deal with aging lead pipes and other water and sewer infrastructure to comply with clean water regulations. Changes in populations means that certain places have a greater need to revamp their systems.

With little additional funding coming from the federal government, those repairs, combined with a higher rate of droughts around 2012-2014, have led to higher rates on consumers.

Education, Reading, and Household Supplies

Other items would also see wide divergence from inflation. Spending on reading (books, magazines, newspapers) as well as apparel and household furnishings is far below inflation, while housekeeping supplies is far above.

What might not be much of a surprise is that education spending has grown 93 percent. That figure is in line with various estimates on the growing cost of tuition. A 2021 report from CollegeBoard, a non-profit member organization focused on higher education, listed the average cost of tuition for a 4-year public institution in 2021-2022 (410,740) being twice what it was in 2001-2002 ($5,720) when adjusted for inflation.