The electricity grid of Texas has regularly been promoted as a shining example of energy deregulation, and the state has some of the cheapest electricity prices in the nation, largely thanks to it being the largest energy producer in the nation with a large natural gas pipeline network.

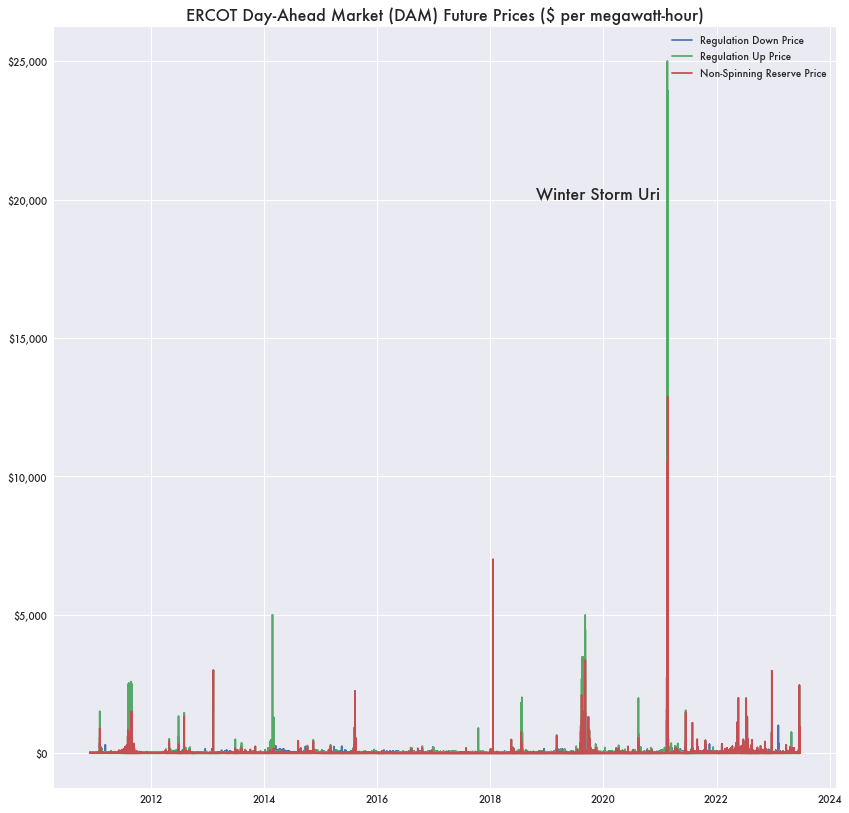

That all failed in 2021 during Winter Storm Uri as Texans got hit with sustained freezing temperatures that led to a massive spike in electricity demand and prices, rolling outages, and numerous deaths from hypothermia. Commercial industries and residents were hit with excessive electricity bills, leading to large debt and bankruptcies.

According to a report from the independent research firm Potomac Economics, the failures came from a slew of market rule failures and decisions at the utility level.

One reason for the massive spike in prices was that the Texas Public Utility Commission (PUC) manually set prices to their maximum price cap—$9,000 per megawatt-hour for a sustained period, even after demand declined. In ordinary times, Texas energy prices hovered between $25 to $50 per megawatt-hour.

Energy utilities usually have these rules at periods of peak demand to encourage more generators to come online and produce more electricity.

But the period where prices were at their market cap didn’t always coincide with a lack of supply. For some of that period, generators were reducing demand with what’s called load shedding—wherein electricity producers don’t provide electricity to all of its customers at once.

Additionally, there was no reason to entice more generators to come online as there was no additional supply available. All available suppliers were already delivering what they could.

The price setting logic has already been the center of lawsuits, like that brought by energy provider Vistra who wound up paying out $1.6 billion to generators during the storm.

But there were numerous other issues as well. Some of the load shedding affected power utilities who also depend on the electric grid to power their generators. Without that electricity, they too went offline, decreasing supply and increasing prices even further.

A separate rule established that once high prices existed for an extended period of time, they revert to a lower price cap. That lower price was either a more reasonable $2,000 per megawatt-hour or 50 times the current natural gas price.

That lower cap may have been designed by someone who assumed natural gas prices in Texas would always be low, which they certainly weren’t during the storm. Spot prices for natural gas at the time topped $400 per million BTUs, or over 100 times the Texas average of $3 per BTU.

Based on those natural gas prices, the lower price cap was up to $20,000 per megawatt-hour—triple the higher price cap.

Utility Commissioners

In a story for Texas Monthly, one of the PUC commissioners was recorded telling Wall Street firms invested in Texas energy that he would make sure the excessive costs paid for electricity weren’t returned. The implication is that the price setting maneuvers were made by the PUC on behalf of the investment firms, who stood to profit handsomely from the price spikes.

Members of the PUC are appointed by the governor, and the commissioner in question was promoted by Texas Governor Greg Abbott. They regulate the rates and rules at which utilities pay for electricity. While banks are not utilities, some of them have power trading desks that are invested in utilities and energy contracts. 1

Similarities to Enron and Others

A deregulated market combined with flawed rules during a period of extreme demand is very similar to what happened during the 2001 California energy crisis. Back then, the state was suffering from a lack of supply because a drought hampered generation from a hydroelectric dam.

California had recently deregulated its energy market to allow in more generators that could all bid in the power markets. But without price caps, the cost of electricity went through the roof during the drought. On top of that, certain generators intentionally went offline to help lower supply and drive up the costs even further.

Following the California energy crisis, Enron, which ran the energy trading markets in California, would fall into bankruptcy for a variety of reasons. Much of its power trading business would be folded into the power trading desks of banks such as J.P. Morgan and Citigroup.

Ongoing Resiliency Problem

Sharp spikes in demand leading to ridiculous pricing and outages have been an ongoing concern for some time now. The proliferation of intermittent sources like solar and wind energy with the larger dependence on natural gas has brought concerns about resiliency—the ability for the electric grid to withstand sudden demand shocks.

Natural gas is the most common source of price spikes because of just-in-time delivery of natural gas—for the most part it can’t be stored on-site at a generator. And despite the overall decline in cost for natural gas following the shale revolution, electricity prices keep increasing, especially in places like California.

Government agencies like FERC and NERC have brought the subject up in past reports. Regional transmission operators (RTOs) like PJM have implemented additional market mechanisms to subsidize capacity and subsidize more resilient forms of energy generation.

Correction: A prior version of this story indicated that Bank of America was invested in Texas’ energy grid. While Bank of America was on the call with the Texas PUC, there’s no detail about whether they are substantially invested in Vistra or other Texas utilities.

So what are the flaws? Capacity versus energy? Price caps too high?

Also -- citation needed on "Bank of America’s power trading arm are heavily invested in utilities and energy contracts."

Are Wall Street banks invested in utilities? If so, they're losers in the Texas PUC decision, which your own link says the PUC Commissioner is trying to "keep billions of dollars from being returned to utilities."

But wait....someone just said "Bank of America's power trading arm is heavily invested in utilities" and thus the PUC Commissioner's statement is a huge loss for Wall Street! Because billions won't be returned to the utilities in which power trading arms hold investments.

Or wait...no...umm...what's actually happening here?