Peer-to-Peer Lenders Struggle to Compete with Brick and Mortar Banks

Peer-to-Peer (p2p) lenders such as Social Finance (SoFi), Prosper, and LendingClub have been around for over a decade by now. They offer a new way to lend money, not via standard bank deposits, but as loans from other peers. And such they don't require the same regulatory overhead as brick and mortar banks.

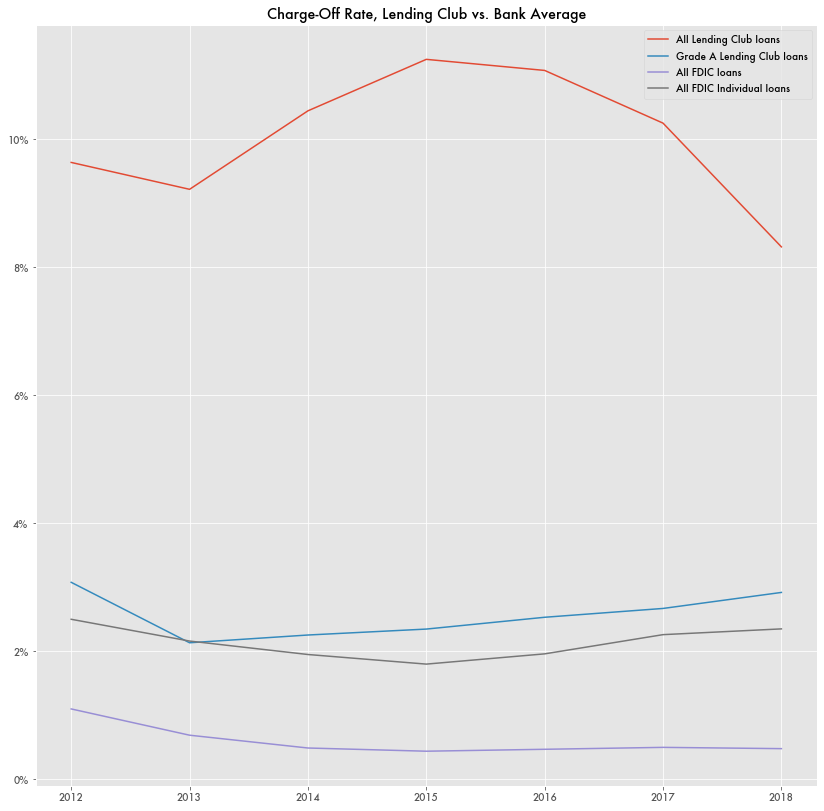

But loan data shows that these lenders have struggled to compete with average banks in numerous ways. LendingClub loan performance data shows the firm has average charge-off rates—the rate at which loans are written off their books and assumed to be unrecoupable—that hover between 9 and 11 percent. Based on Federal Deposit Insurance Corporation (FDIC) data, average bank charge-off rates for individual loans rarely top 3 percent. Only LendingClub's top tier grade A loans have a charge-off rate that was comparable.

In 2016, Prosper published loan performance data showing an average charge-off rate of 6 percent. Similarly, only their top tier loans, A and AA, had charge-off rates comparable to the FDIC average.

Similarly, for returns, LendingClub publishes annualized returns of between 5 and 8 percent since 2012. Average return on equity for banks listed in FDIC data was around 9 percent, and upwards of 12 percent in 2018.

Independent banks have not been a fan of the entrance of peer-to-peer lenders in the market. The Independent Community Bankers Association (ICBA) even went so far as to ask the FDIC to reject SoFi's application on the grounds that it violates the separation of banking and commerce under the Bank Holding Company Act (BHCA). Under that act, banks are prevented from being owned by commercial interests and vice versa to prevent conflicts of interest and abuse in industrial lending.

Peer-to-peer lenders like SoFi are sometimes owned by larger conglomerates, which is a situation not covered by the BHCA, but considered by the ICBA to be a loophole in the law. If exploited would enable much larger companies like Wal-Mart and Google to be their own banks.

Peer-to-Peer lenders also use other unique agreements with individual banks so they can provide other bank-like services such as credit cards. These banks are often in states, like Utah and New Jersey, with low banking regulations and few limits on interest rates. In 2015, the Madden Decision set a precedent that limited the ability of lenders to export high interest rates from outside states.