Meatpackers Reap the Benefits as Cattle Prices Fall Flat Following Country-of-Origin Labeling Repeal, Currency Devaluation

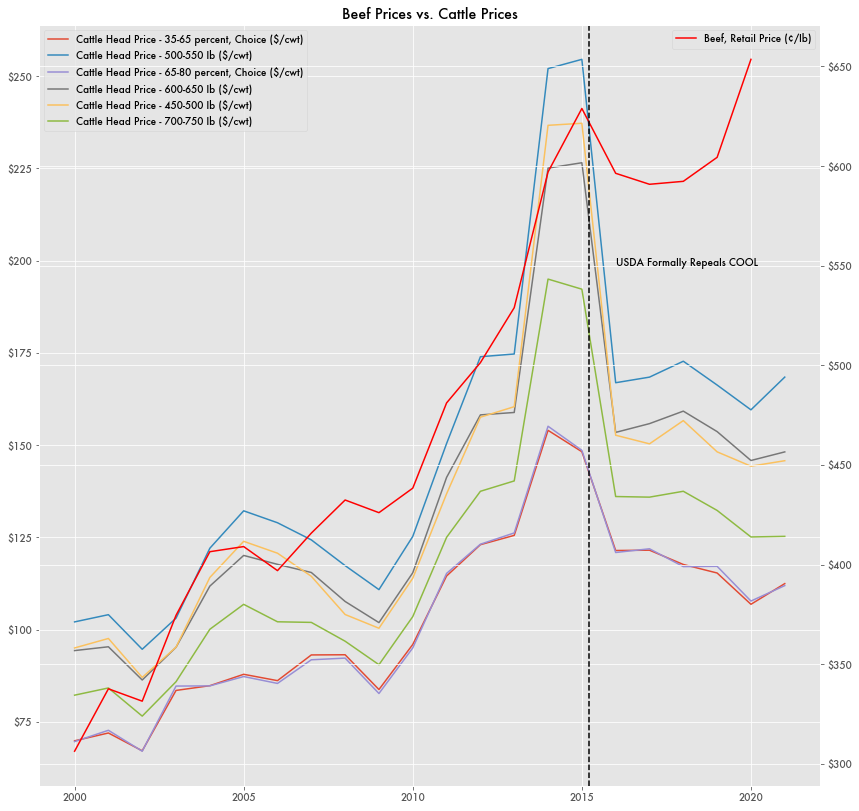

For years, the price of cattle followed in almost lockstep with the price of beef. Prices for cattle went up as beef prices went up.

Going back to 2000, the spread between the farm price and the wholesale price of beef averaged about $35/lb, and barely tipped above $56/lb. Since 2016, that spread has widened considerably. It now averages $76/lb, and was over $167/lb in 2020.

Much of this comes from a collapse in cattle prices. As beef prices remain relatively stable, the prices paid for heads of cattle have fallen by half.

Country-Of-Origin Labeling

The year of 2016 is also when Country-Of-Origin Labeling (COOL) was eliminated by the U.S. Department of Agriculture (USDA). Congress mandated COOL back in the 2002 farm law, although the rules were only formally effective in March of 2009. The rules stipulated that unprocessed meat sold in the U.S. had to carry one of a number of labels detailing which country the cattle were born and slaughtered in.

Immediately after implementation, Canada and Mexico, the two largest exporters of cattle to the U.S., disputed the labeling laws through the WTO as a barrier to trade. Both countries blamed labeling for a sharp decrease in exports and a substantially lower cost paid for their livestock. Canadian Minster of Agriculture Gerry Ritz accused COOL of causing a 49 percent decline in feeder cattle exports to the U.S. from 2008-2009.

In July of 2015, the WTO made a determination of $1.05 billion in export revenue losses to Canada's cattle and hog industry, and $227 million to Mexico's based on econometric analysis. The U.S. challenged all of the allegations, claiming that the calculations were based on “unrealistic assumptions” and that the export revenue loss methodologies were fundamentally flawed and based on incomplete and unsubstantiated data. The U.S. attempted to explain the market changes on other variables—such as economic fluctuations and lingering effect of bovine spongiform encephalopathy (BSE) in Canadian cattle—but the WTO committee disregarded those additions.

While labeling may have had an effect, the major cause of declining Canadian cattle exports was a liquidation phase in the Canadian cattle cycle from 2005-2011.

Because of a high U.S. dollar, rising feed costs, and an inflated inventory following the 2003 BSE investigation, Canadian feedlots were liquidating their inflated inventory through exports, and that liquidation occurred while COOL was implemented.

In 2008, the USDA predicted that Canadian exports would decline in 2009 because of diminishing inventory following the BSE discovery, high value of the Canadian dollar, and rising feed costs. Overall, COOL did not appear to effect total U.S. livestock imports since an increase of imports from Mexico made up for the lack of imports from Canada.

Besides the liquidation phase, Canadian cattle exports to the U.S. continued to decline even after COOL restrictions were repealed in 2016.

And despite the implementation of COOL, total imports to the U.S. from Canada and Mexico, the two main non-domestic sources, rarely varied and has averaged around $1.8 million a year before, during, and after COOL.

Exchange Rates

Besides the repeal of COOL, exchange rates since 2016 have favored importers. From May 2014 to May 2019, the Mexican peso went from 13 per U.S. dollar to 19 per dollar (46 percent change).

A similar devaluation happened for the Canadian dollar. Over the same period of time, it went from being on par with the U.S. dollar to 1.34 per dollar (34 percent increase). In both countries, the devaluation started in 2014, predating the repeal of COOL and the changes in cattle pricing.

Meatpackers and Ranchers

Bill Bullard, a representative with the Ranchers-Cattlemen Action Legal Fund, United Stockgrowers of America (R-CALF USA) recently told economist Matt Stoller that the difference between what the middlemen pay for cattle and what they sell as meat has meant windfall profits for the large meatpacking monopolies, which control 85 percent of the market.

He has also accused those companies of conspiring to keep price data out of the markets, preventing cattle ranchers from knowing the market price that they could obtain, as well as leaning on cheaper imported cattle to "[deprive] the American cattle producer of access to their own domestic market" and maintain monopolistic control.

While imported cattle may be cheaper by the head, they include transportation costs that are not factored into their market price and there are time sensitivities involved in bringing cattle to market. Rather than risk undervaluing their stock or not being able to sell on the market, many cattle growers have entered into long-term contracts with the meatpackers.

Meatpackers have previously defended the removal of COOL as “beef is beef” independent of the country of origin, although ranching representatives like Bullard believe there is a benefit to U.S.-raised beef that warrants labeling.