Little Correlation Between Gasoline Prices and Inflation Until 2021

In testimony to the Senate Banking Committee in March, Federal Reserve Chairman Powell stated that every $10 increase in a barrel of oil leads to a .2 percent increase in inflation.

That is, oil is inextricably linked with inflation. Not just the direct cost to consumers for gasoline, but because petroleum is instrumental in almost every aspect of the economy—transportation, plastics, and energy production—it indirectly affects all costs. Or at least it should.

And as gas prices have skyrocketed following the Russia-Ukraine conflict, so has inflation, which in turn has led to more Federal Reserve research about how oil prices contribute to inflation.

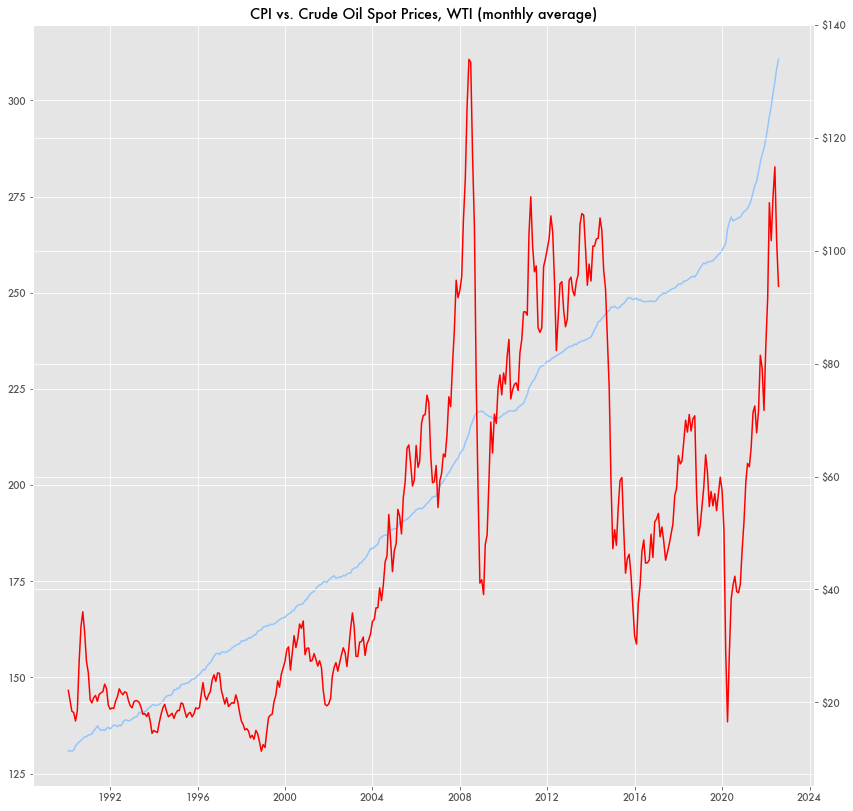

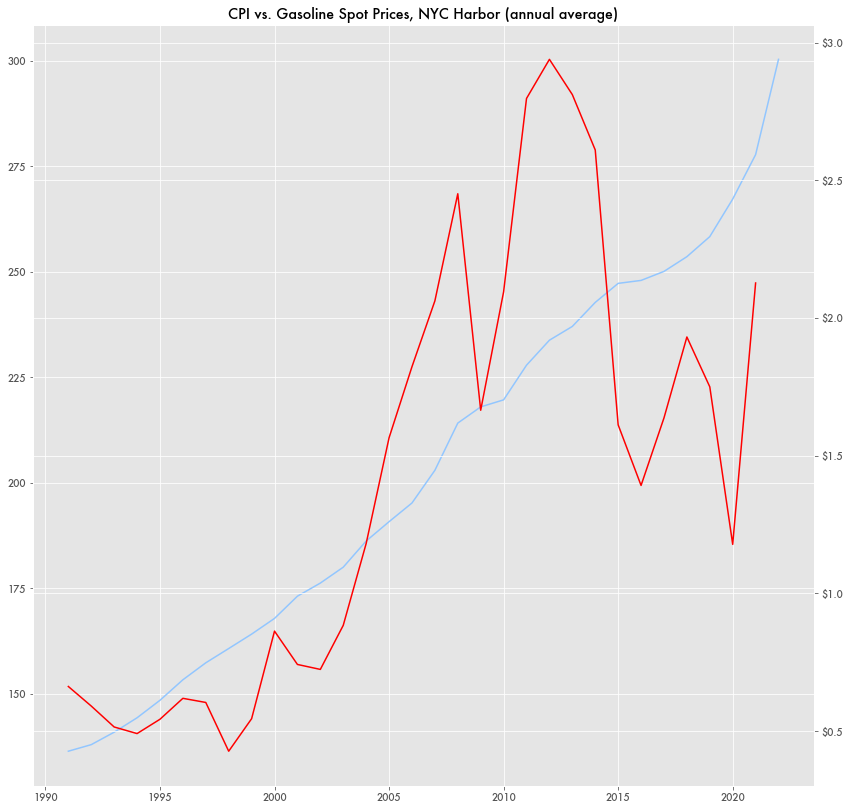

Yet before 2021, oil prices seemed to have little correlation with gas prices. Gas prices would shoot up one year and fall back down another while inflation has been relatively constant. If oil prices were affecting inflation, the effect was negligible.

The two values do relatively correlate in that they both have tended to increase over time. But as a predictor of inflation, oil prices appear unrelated.

Numbers are based on U.S. Energy Information Administration (EIA) data for West Texas Intermediate (WTI) crude oil spot prices and New York Harbor spot gasoline prices.

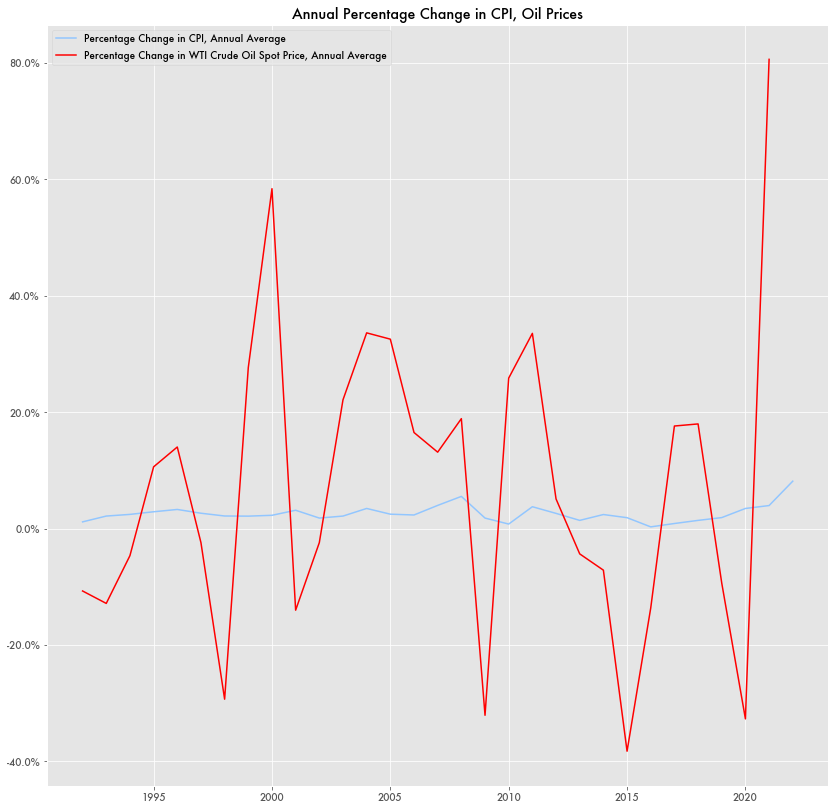

In general, oil prices are considered volatile. Year-to-year, month-to-month, and sometimes day-to-day prices can vary by tens of dollars a barrel.

In contrast, the Consumer Price Index (CPI), which determines inflation, is relatively consistent.

In the U.S. since the 1990s, annual inflation—the yearly percentage change in CPI—has been 1 to 3 percent a year. Some exceptions include 2021-2022 and 2008 around the financial crisis when inflation went over 5 percent.

Oil and gasoline price changes, on the other hand, have varied between 80 percent and -38 percent. The annual average change is 7 percent.

Examples of Divergence

Throughout most of the 90s, oil prices declined as inflation held constant. Between 2004 and 2012, oil prices would increase 125 percent; CPI over that time increased about 25 percent—or about 3 percent a year. Gas prices topped $4 a gallon in 2012 with little change in inflation.

In 2016, oil prices crashed while inflation remained relatively stable.

Crude oil prices in 2008 were higher than they are now yet annual inflation for that year was a mediocre 2.6 percent.

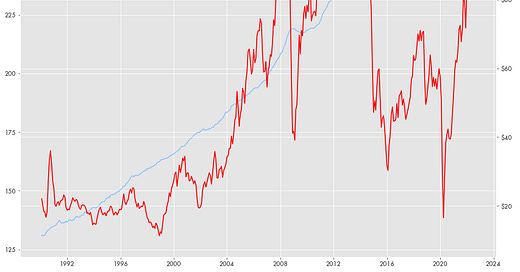

PCE vs. Oil Prices

While CPI doesn’t include direct expenditures on food and energy, like gasoline, the Personal Consumption Expenditure Index (PCE) does. But it also doesn’t correlate with oil prices except during periods of price shocks.

Similar to CPI, there are periods of substantial oil price swings while PCE increases steadily.

Only around 2008 and 2020—the financial crisis and the beginning of the pandemic—will you see a strong correlation as both values move in tandem.

Current Correlations

Since 2020, oil prices have increased around $100 a barrel. And while oil and inflation now seem to now move in lock-step, inflation since 2020 is now on the order of 18 percent—9 times Powell’s estimate (.2% per $10 increase x $100/barrel increase = 2%).

Besides oil prices, inflation can be driven by a host of causes, including the large growth in the money supply such as pandemic government spending like the Paycheck Protection Program (PPP).

If anything, Powell’s estimate might have been prescient for the 2020 collapse in the price of oil. In April of that year, oil prices dropped around $50 in one day, ending in negative prices for a short period.

Over the course of that month, crude oil prices would decline $12.66 a barrel. A few months later, July would see one of the few declines in inflation in recent history—-.3 percent—equivalent to a $15 decline in the price of oil by Powell’s formula.

But that correlation doesn’t hold for other months in 2020 when oil prices fluctuated in both directions and inflation held steady.

Why crude oil prices may now be driving inflation in 2021 after decades of independence is not known.