Job Openings Only Decline During Recessions

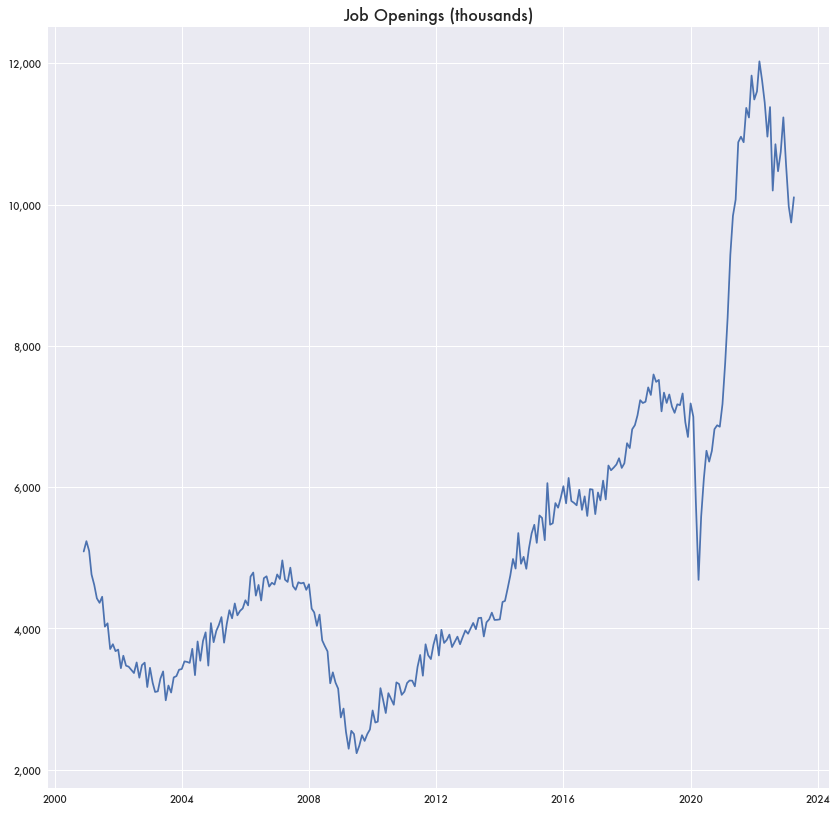

In May of 2023, the economy added 339,000 jobs to total non-farm payroll employment—a sign that the economy was continuing its comeback from the pandemic.

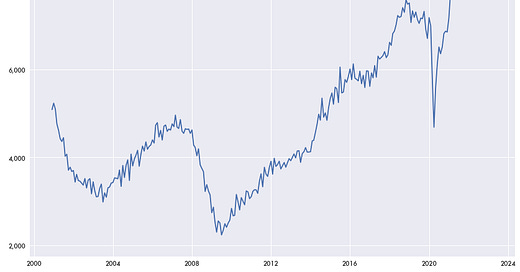

Additionally, 496,000 job openings were lost to a total of 9.8 million outstanding job openings according to Bureau of Labor Statistics (BLS) data from the Job Openings and Labor Turnover Survey (JOLTS).

What’s unique about that change in job openings is that it’s one of the few decreases of job openings in recent years. Of those 9.8 million total job openings left, many could have been there for over a decade.

In 2009, there were over 2.2 million job openings. Since then, there hasn’t been a month where it was less than that.

That implies either many of those 2.2 million current job openings have either never been filled in 13 years, or they get filled (or removed) and then replaced with even more job openings.

Ostensibly, as jobs are filled and employment increases, the number of openings should go down as some amount of those new jobs come from open job opportunities. Yet the growing number of net jobs added each month to the economy—i.e. new hires minus new separations, or the change in total employment—hasn’t made much of a dent in total openings until this last year. More people being hired to new jobs only led to more job openings, not less.

This last year is the first time that job openings substantially decreased since 2009 outside of the pandemic, and that’s only after it reached a peak of over 12 million in 2022—almost three times what it was in 2008. Since 2009, new job openings were added practically every month—there was a slight lull in growth around 2016.

Even during the pandemic as the economic came to a standstill, openings collapsed. Yet there were still around 3 million more than in 2009.

When Job Openings Declined In The Past

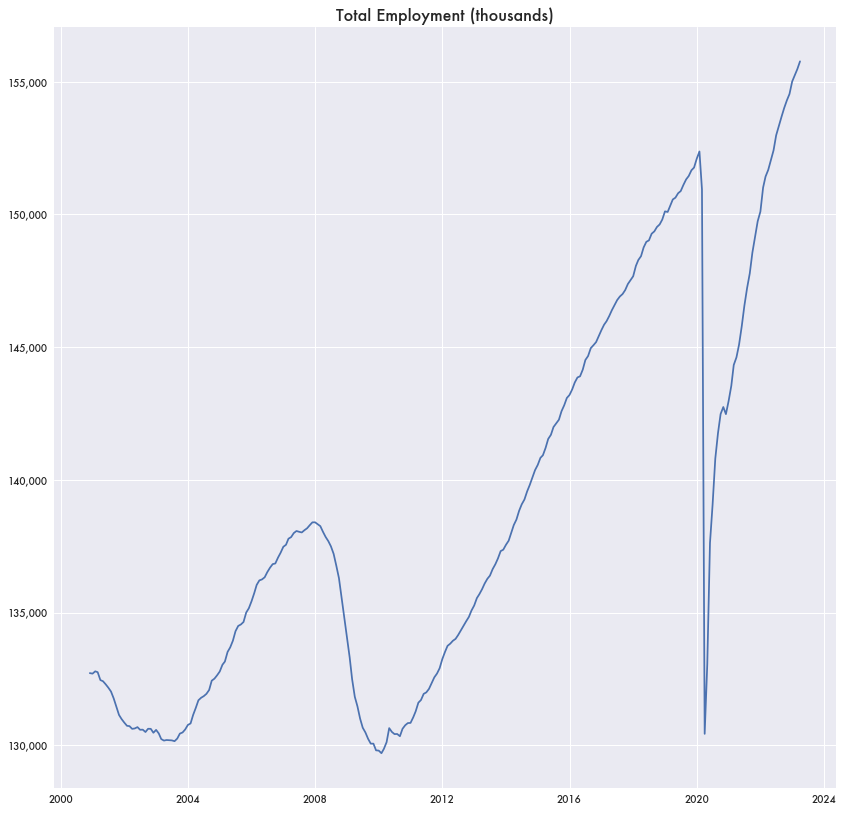

Another data set that measures an equivalent metric is the Help Wanted Index. Collected by a private company, The Conference Board, it was originally based on help wanted ads in newspapers but is now based on help wanted ads online. The index doesn’t measure exact jobs but a relative index metric.

That metric also tracks with the JOLTS data since 2009, showing a steady growth in job openings. But it also has much older data going back decades.

Prior to 2009, job openings were relatively cyclical, collapsing during each recession—about every ten years based on a paper published by the Federal Reserve Bank of San Francisco.

But with those recession collapses, the Help Wanted Index never goes below a certain value. In the Northeast it’s about 40. The midwest is about 50. In the West and South it’s more like 60.

It’s as if there is a certain quantity of jobs that are never filled going back decades.