Investment Fund Record-Keeping Industry Continues to Consolidate

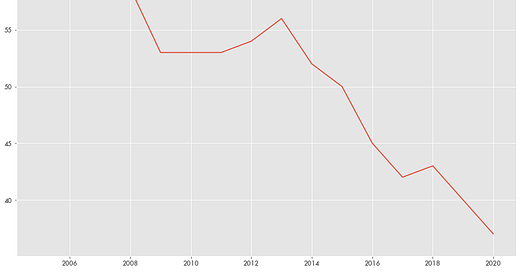

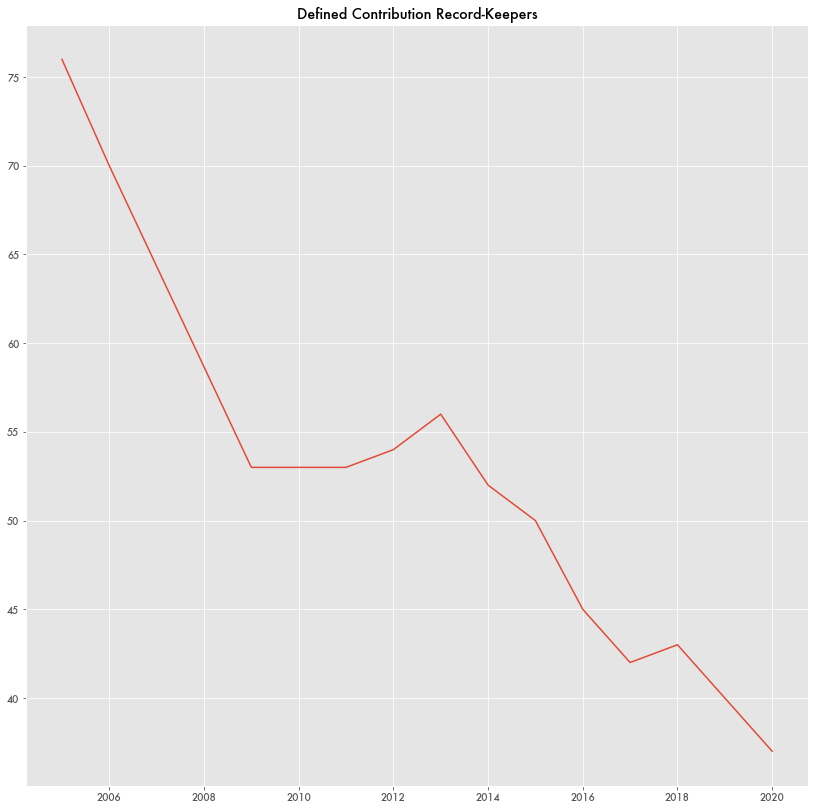

The number of investment record-keeping firms—companies that manage and track investment funds like 401(k) plans but don’t give investment advice—has been in sharp decline over the last two decades. In 2005 there were 76 firms. That's been narrowed down by half, and only 37 firms remain.

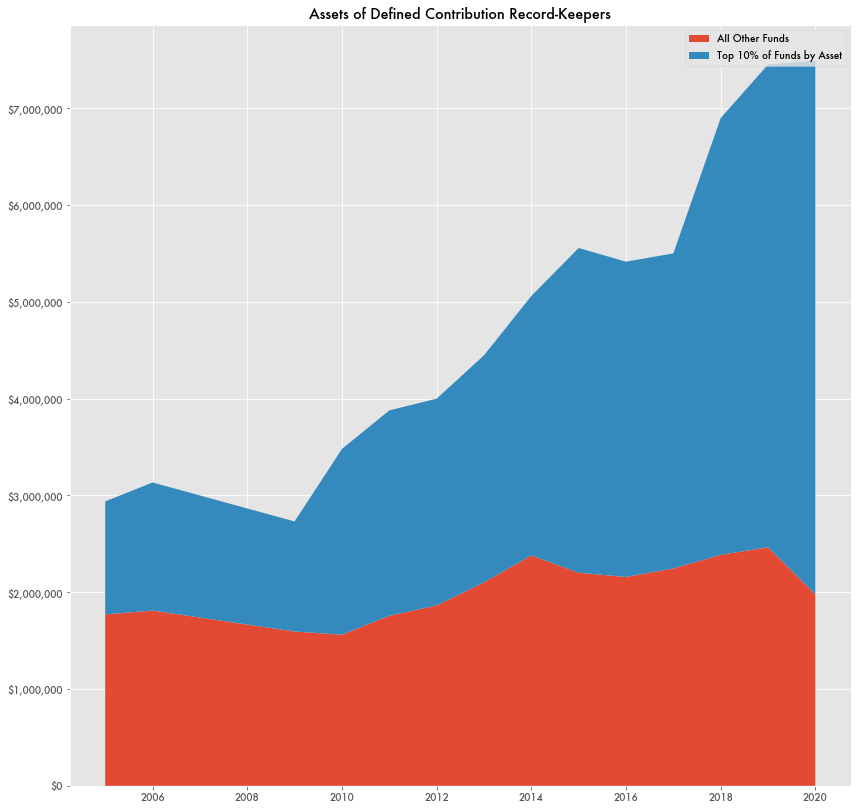

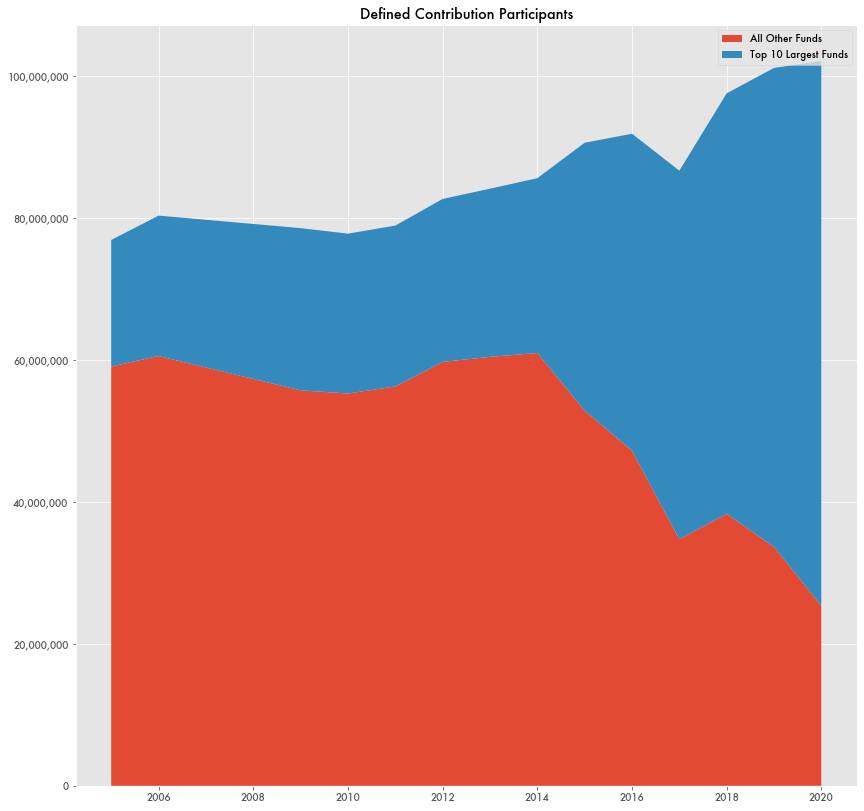

Consolidation is the likely culprit as plan participation has never been higher. In the same time period that record-keeping firms disappeared, assets held by the remaining firms have doubled and the number of sponsors has grown steadily as well.

The top ten firms now wield a much larger slice of the market, with Fidelity Investments holding the largest portion, representing $2.2 trillion in assets–30 percent of the market in 2020.

Fidelity may dominate the industry in total assets, but it is companies like ADP Retirement Services and Paychex that have the largest number of plans under their purview. Together, those two companies hold 27 percent of plans.

Not all firms report their data each year for various reasons. For example, the total number of reported sponsors dropped in 2017, largely because of non-reporting from two firms: Transamerica Retirement Solutions and Security Benefit Corporation. Security Benefit Corporation was acquired by Guggenheim Partners in 2016.

Consolidation has previously been ascribed to lower profit margins, lower fees, increased cybersecurity requirements, and more sponsor demands. Insurance companies now look to acquire record-keeping operations as a way to cross-sell products.

The turning point in market consolidation is 2014. Before then the largest plans and the smallest plans relatively grew in sync. Since 2014, they diverged with smaller plans holding a smaller and smaller share of sponsors and participants.

Since then, the largest record-keepers by asset have grown because of growth in the largest plans—those with over 25,000 participants.

Record-Keeping Fees

Prior to the recent consolidation in the market, record-keeping fees collapsed according to what investment consulting firm NECP called a “race to the bottom.” Firms trying to out-compete each other were repeatedly lowering costs, which eventually eats away at the fund’s operating budgets.

Fees that previously averaged $111 per person in 2011 fell to $64 in 2015 according to survey data from NECP. Since 2017, average rates have leveled off.

In 2012, new rules for direct compensation plans ushered in fee rate transparency for plan sponsors, which was already leading to lower rates before the rule was passed.

Industry M&A

Mergers and acquisitions are one source of consolidation. At least 14 M&A deals list record-keeping firms that no longer report, such as the takeover of Hartford Financial Services Group by Massachusetts Mutual Life Insurance in 2012 or OneAmerica's acquisition of City National Bank's record-keeping arm in 2014. Most recently, Principal Financial announced the takeover of Wells Fargo's record-keeping business for 1.2 billion in 2019.

While Fidelity's growth has been nothing short of exponential, it hasn't been through M&A. The company doesn't appear in any deals related to record-keeping or otherwise.