Hawaiian Utility Was Paying Exorbitant Prices For Fuel Oil

As previously highlighted in Investigative Economics, Hawaii pays the highest price for electricity in the U.S. by far. It now pays even more since it shut down its only coal plant—the AES plant on O’Ahu, a longstanding source of cheap electricity going back decades. The main source of energy on the island, petroleum, is one of the most expensive fuel sources available, and it has only gotten more expensive.

But it wasn’t just that international oil prices were expensive, the island’s electric utility, Hawaiian Electric, was paying beyond top dollar in 2022 for refined fuel oil to power its turbines despite the sole refinery on the island sourcing its crude oil from across the globe.

All this while oil prices were at record high prices. The island went from paying high prices for fuel oil to paying massively exorbitant prices that would be passed on to rate payers. Electricity rates went from an already egregious 30¢ per kilowatt-hour to 40¢ per kilowatt-hour.

While record high oil prices and spreads were a boon for the island’s lone refinery, Security and Exchange Commission (SEC) filings make it seem like they should have been earning much more considering how much the utility was paying them. But if the refinery wasn’t reaping the benefits of high electricity rates, who was?

Record Oil Prices, Record Spreads, But Power Utility Paid Beyond That

Oil prices in 2022 hit record highs as the Russia-Ukraine war limited the amount of petroleum in distribution, driving up demand. And Hawaii would feel the pinch.

Average landed value of crude oil in Hawaii based on Census port-level import value estimates would go from the relative low of $48 a barrel in 2020 to $87 a barrel in 2022 (assuming heavy crude density of 813.3 kg/m3).

That price is in line with international oil spot market benchmarks like West Texas Intermediate (WTI, $94 per barrel) or Brent ($99 per barrel) for the time.

Besides the high cost the island pays for electricity, Hawaii also has some of the highest prices for motor gasoline as well. Gasoline prices hit a historic high of $5.62 a gallon in 2022 based on AAA’s Gas Prices data.

Without its own production, Hawaii is dependent on international sources of oil for electricity generation as well as motor gasoline and other uses. According to the Energy Information Administration (EIA), Hawaii regularly sources most of their crude oil internationally, largely from Argentina and Libya. Although numbers from shipping data firm Trademo lists numerous other countries around the globe: Malaysia, Indonesia, the Congo, and Trinidad and Tobago among others. Russian oil via Singapore had been a major source of crude up until 2022 when the Ukraine-Russia war restricted trade.

Importing oil from foreign countries might be reasonable as Hawaii is located far from other oil producing U.S. states like Texas and relatively close to Asian trading hubs like Singapore. Rather than Texas-based benchmarks like West Texas Intermediate (WTI), the sole refinery on the island, Par Pacific, gauges their potential profits using the Singapore 3-1-2 crack spread—a metric that tracks the difference in price between crude oil and refined fuels like diesel.

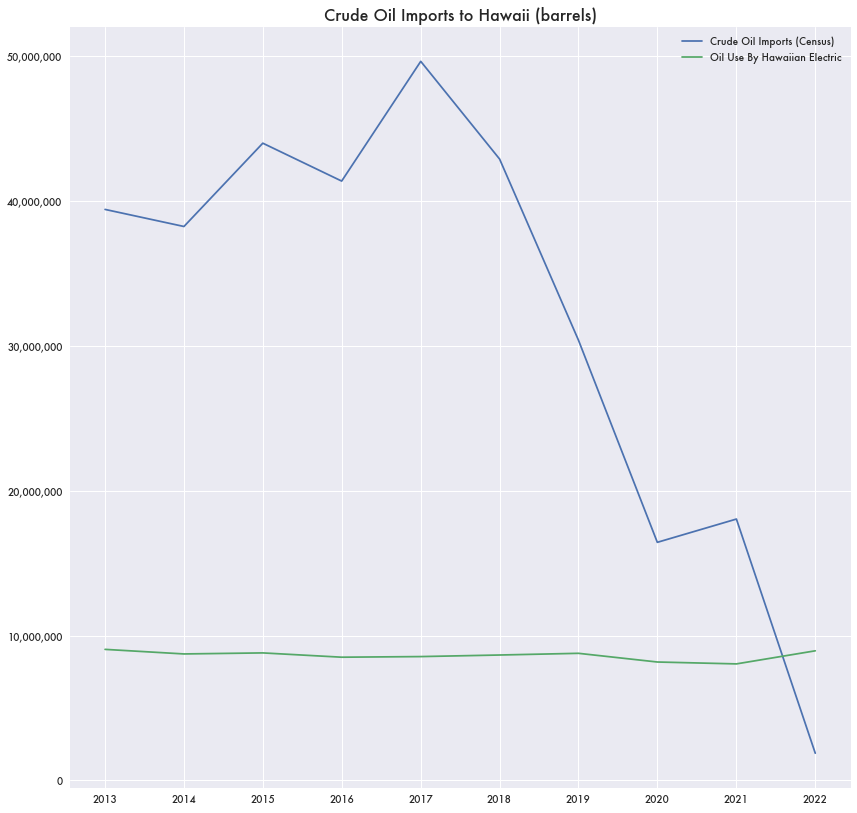

But recent Census trade data shows a stark decline in international shipments of crude to Hawaii. So much so that the island imported less in 2022 than it used to generate electricity.

Trade data does not include domestic shipments, so ostensibly, Hawaii could be importing much more of its oil from other U.S. states.

Paying Far Beyond the Crack Spread

While crude oil prices were at record highs in 2022, crack spreads—the difference between crude oil prices and refined fuel prices like diesel and low-sulfur blends used for generating electricity—were also at record highs.

The Singapore crack spread was also at a substantial high of $25.43 per barrel based on Par Pacific’s SEC filings. In prior years, it wavered between $5 to $12 per barrel.

While the crack spread doubled, Hawaiian Electric was paying even beyond that. SEC filings show Hawaiian Electric paying $140 per barrel for fuel oil to power its turbines.

Even with high crack spreads ($25.43 per barrel) and the high price of crude at the time ($88 per barrel), that doesn’t get close to the $140 per barrel price that Hawaiian Electric was paying.

The spread between the average landed cost of crude and the price paid for fuel oil by Hawaiian Electric was $55 per barrel in 2022. In previous years, the difference between estimated crude oil value and average cost for fuel oil would be as low as $2 a barrel (2007). In 2021 it was $10 a barrel.

Massive Spreads But Mediocre Refiner Profits

Based on those numbers and Hawaiian Electric’s use of around 10 million barrels of fuel oil a year, the utility would ostensibly be paying tens of millions more than might be expected, and most of that would likely be going to the refinery—Par Pacific.

Yet according to Par Pacific’s SEC filings, the refiner wasn’t earning that much. Adjusted gross margins per barrel were $13.99 in 2022.

That’s a decent improvement from 2021 ($4.56), leading to more total profits for the year. But with crack spreads on the order of $20 to $35 more than the previous year, that should ostensibly lead to much higher gross margins.