Financial Crisis Post-Mortem: Delinquencies and TARP Funds Led to Regional Bank Mergers

Between major national banks, like Bank of America and Wells Fargo, and smaller community banks lie regional banks: banks that sometimes span multiple states with numerous locations but aren’t the size of national banks.

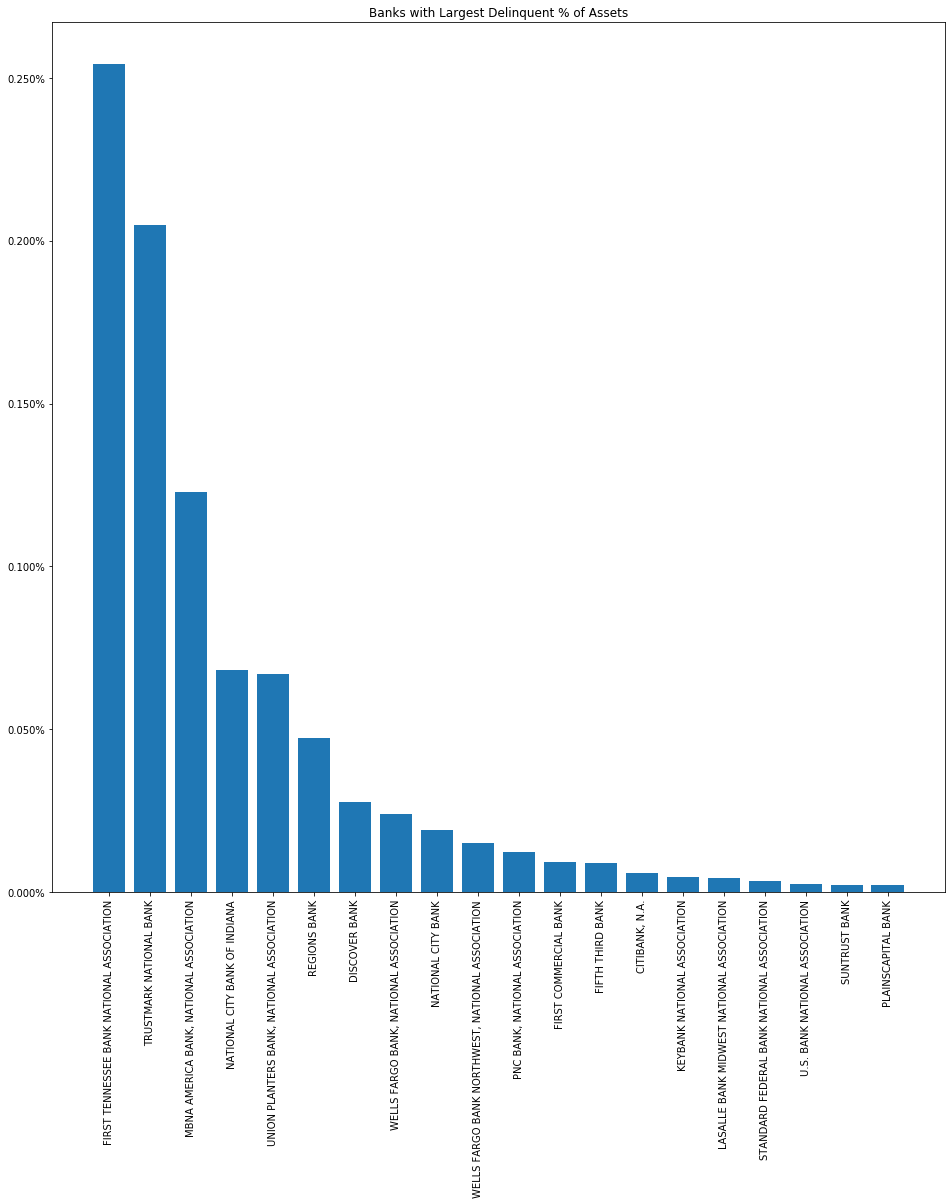

Surrounding the subprime mortgage crisis, thousands and thousands of borrowers would fall delinquent on their loans and regional banks would hold the top spot for the highest percentage of delinquent loans.

Following the flood of delinquencies, a number of these banks would collapse, merge, or be bought outright depending on whether they received funds from the Troubled Asset Relief Program (TARP).

An analysis of Federal Deposit Insurance Corporation (FDIC) data from 2005-2010 shows banks like First Tennessee, Trustmark, National City, and MBNA held ratios of delinquent loans to assets at between 2-4 percent. The average for all banks in that period was .01 percent.

First Tennessee, which had the largest delinquency rate, would eventually agree to pay $212.5 million to resolve False Claims Act accusations in 2015 for mortgages that it tried to insure with Federal Housing Administration (FHA), despite poor underwriting standards. Following the crisis, the bank gave up attempts at being a national mortgage servicer. In 2019, the bank would eventually merge with other banks to become First Horizon.

MBNA was acquired by Bank of America in 2005, and with it came a mortgage portfolio that would incur a large number of write-offs during the financial crisis.

National City Bank, a midwest Regional bank centered in Cleveland, was forced into a short-sale to PNC in 2008 after they were denied TARP funds. PNC then received TARP funds following the sale. Former Ohio Congressmen Dennis Kucinich and Steve LaTourette complained about the forced sale of the bank and pointed the finger at the U.S. Treasury.

The Cleveland Plain Dealer quoted LaTourette saying, “regulators and Treasury played God with TARP money and strong-armed National City into a sale in a matter of days, with little concern how shareholders would fare and no regard for the thousands of jobs and lives that would be forever changed.”

Trustmark, a large regional bank in the Mississippi and Alabama area, had the second largest delinquency ratio, but it doesn’t appear to have struggled during the financial crisis. The bank received $215 million in TARP funds, the largest in Mississippi, which was all paid back according to ProPublica’s bailout tracker.

Two Tennessee banks both with large delinquency rates, Regions and Union Planters, would merge in 2004 before the market would crash. Regions would get $3.5 billion in TARP funds and would go through numerous mergers with other struggling banks during the crisis: AmSouth Bancorporation, Integrity Bank, and FirstBank Financial Services.

TARP funds made the difference for Key Bank as well. Through its parent company KeyCorp it received $2.5 billion in TARP funds and would weather the financial crisis to buy up banks in New York from HSBC.

LaSalle Bank on the other hand did not get TARP funds, for either lack of trying or lack of success, and was bought up by Bank of America in 2007.

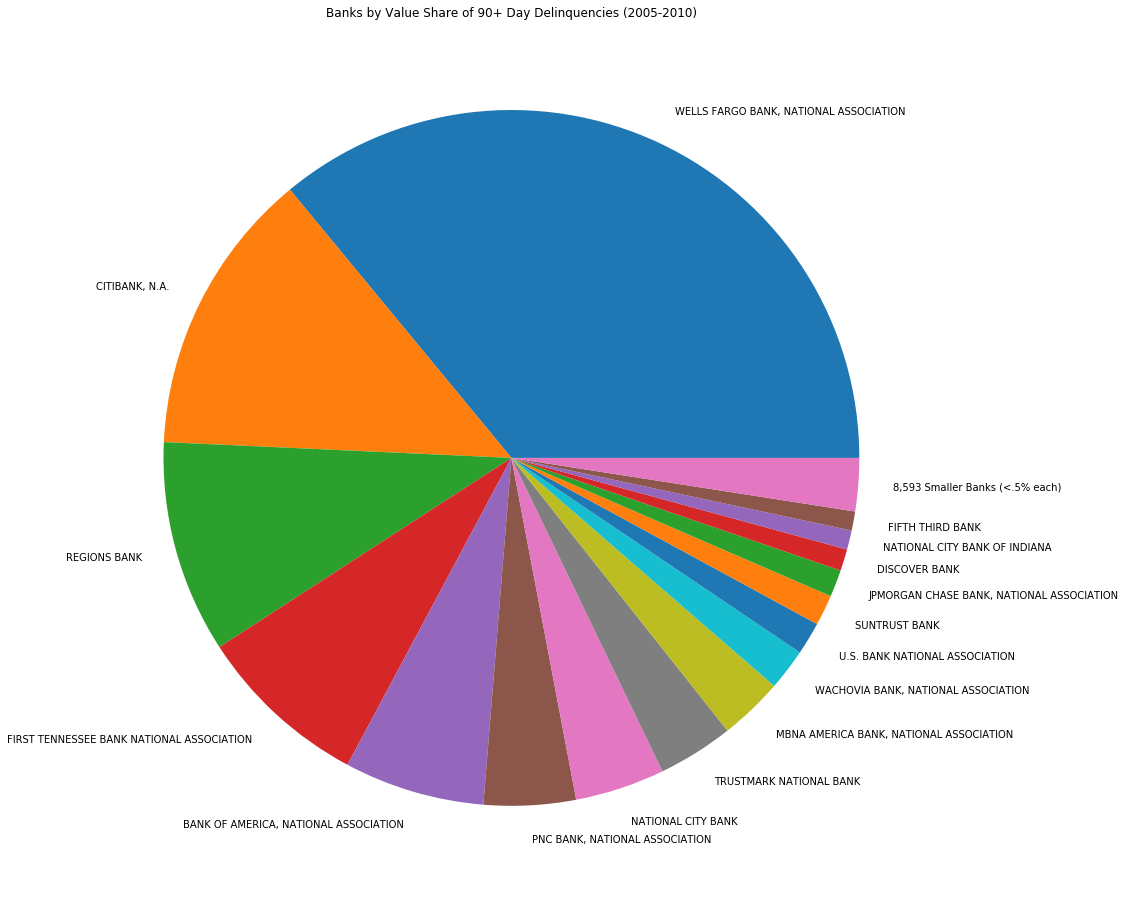

Wells Fargo Held Bulk of Delinquencies by Total

Of the mortgage lenders insured by the FDIC, Wells Fargo stands out for holding the lion’s share of delinquencies in total.

The national bank accounted for over 36 percent of 90+ day delinquencies by value from 2005-2010. Wells Fargo is one of the largest banks in the country and one of the largest mortgage servicers, but its delinquency total at the time dwarfed other major national lenders.

Bank of America, which also operates at a similar scale, only represented about 6.5 percent of total delinquencies. Other major and regional banks, like Citibank, J.P Morgan Chase, PNC, and Regions Bank, accounted for about 50 percent of delinquencies.

Most smaller banks represented less than 1 percent in total. Many states that are home to largely smaller, community banks, like Texas, saw no delinquencies whatsoever.

But despite having so much delinquent debt on its books, Wells Fargo came out relatively unscathed from the Financial Crisis compared to other banks, like Citigroup.

Wells Fargo received around $25 billion in TARP funds, which is relatively small considering the mortgage portfolio of the bank compared to the amounts received by other banks like Bank of America ($45 billion) or other banks with smaller mortgage portfolios, such as Citigroup ($45 billion), J.P. Morgan Chase ($25 billion), and others.

Wells Fargo has been penalized for numerous activities in recent years, including misrepresenting the quality of subprime stated income loans as well as the account fraud scandal where bank employees would surreptitiously create fake accounts under a client’s name.