Electric Utilities Reap the Benefits of Natural Gas Prices

Utility fuel costs for producing electricity have collapsed in recent years as natural gas floods the market for electricity generation.

The beneficiary of this collapse has largely been electric utilities whose revenue continues to climb over the same period of gas price decline based on U.S. Energy Information Administration (EIA) data. Total revenue for utilities from electricity sales were up more than $50 billion per year since 2008. The driver was mainly from sales to residential and commercial customers, although slightly down for industrial sales.

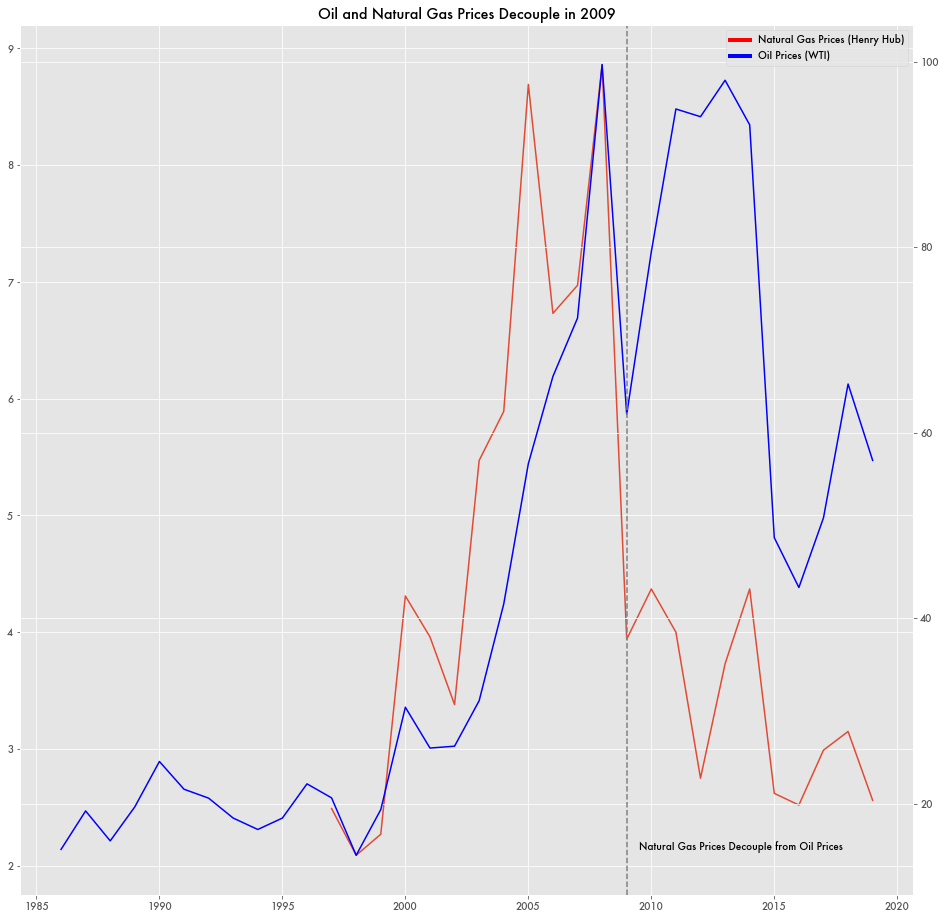

A large driver of the decline has been the sharp drop in natural gas prices, which decoupled from oil prices around 2009.

At the same time as gas prices have declined, the cost of electricity to end consumers has increased. While prices of natural gas for heating have declined for some, average consumer costs for electricity have gone up by about a cent per kilowatt-hour since 2018, mainly for residential consumers. Prices have remained stable for industrial consumers.

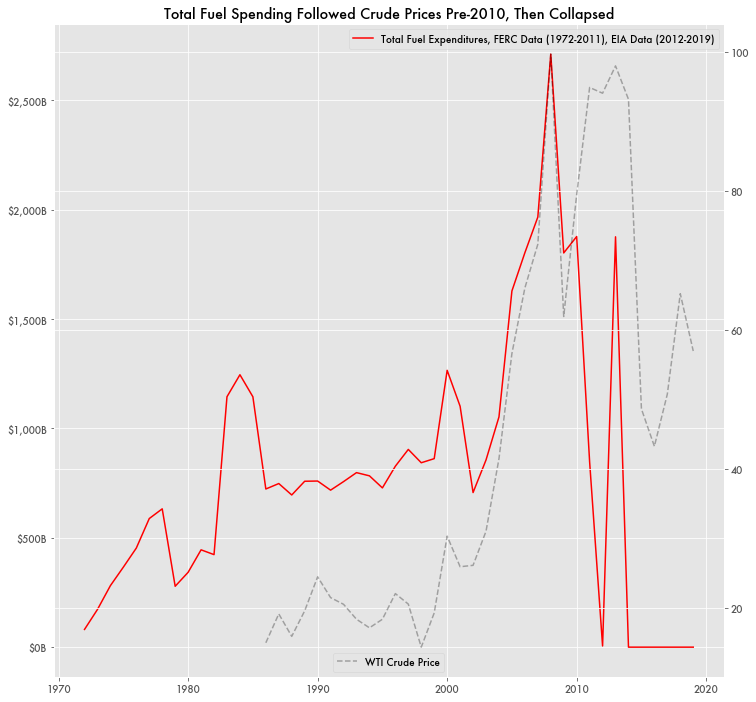

The total amount spent on fuel by electric utilities each year—coal, oil, and natural gas—steadily grew from the 70s through the 90s, but that amount more than doubled from 2000 to 2008. Since 2008, fuel cost expenditures have collapsed. The total amount spent on fuel in a year by utilities now hovers around less than what was spent in 1972 according to EIA and Federal Energy Regulatory Commission (FERC) data (although not adjusted for inflation).

The flood of natural gas into the market for electricity generation was the main driver of change in electricity generation as it recently passed coal as the primary source of fuel for the first time, although just for a month.

While these numbers don’t include nuclear, renewable, and other miscellaneous sources, other reports have also indicated that the levelized cost of electricity (LCOE)—all the net present costs of electricity generation for a fuel averaged together— for most fuels has been in steady decline.

Oil Prices Determined Fuel Costs, Until Fracking

The steep spike in fuel cost expenditures between 2000 and 2008 was likely driven by the price in oil. The West Texas Intermediate (WTI) oil price, a common international oil market metric, during that period heavily correlates with fuel cost expenditures (Pearson value of .96, p < .0001).

At the time, natural gas largely was a byproduct of oil extraction, and natural gas prices followed oil prices.

As the American fracking boom started in the mid-2000s, natural gas prices dropped when the commodity saturated U.S. markets. Rather than a byproduct of oil production, natural gas was extracted on its own and its price decoupled from oil prices.

While oil prices stayed relatively high outside of the pandemic, natural gas prices dropped precipitously. And with it came utility fuel costs.