Disappearing Subsidiaries Were Part of Byzantine Tax Transaction

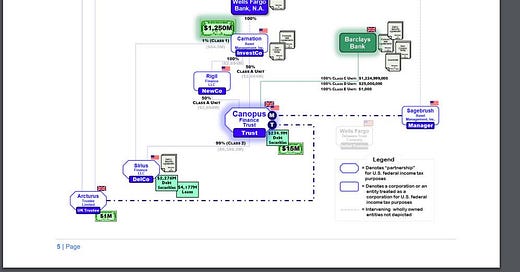

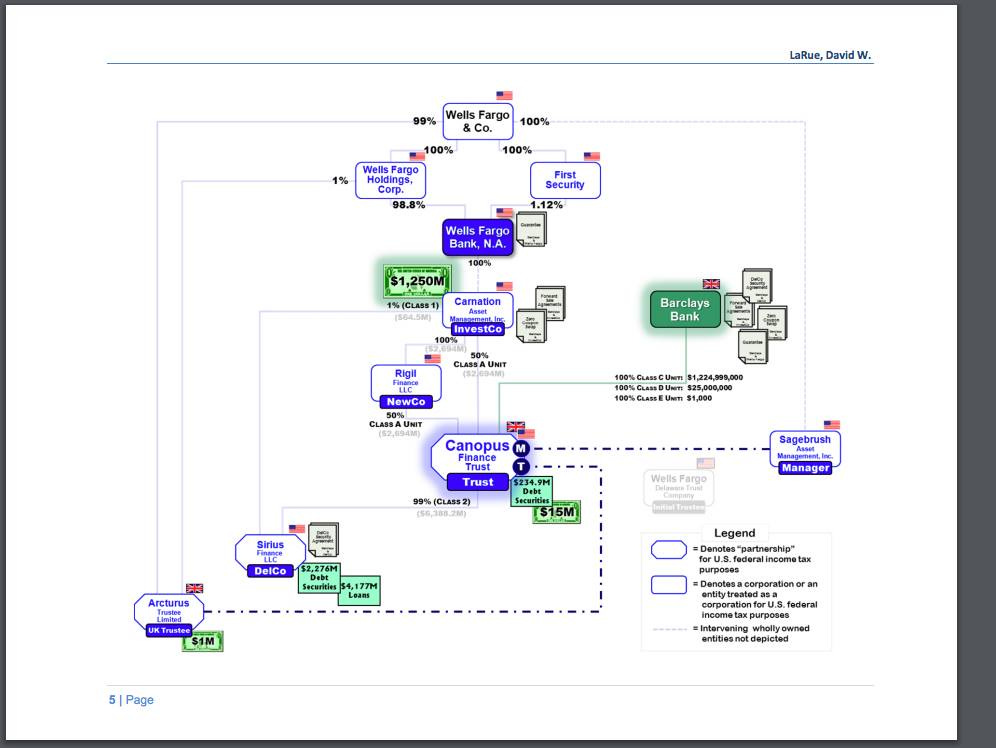

In June of 2020, an appeals court struck down Wells Fargo's infamous STARS transaction—or structured trust advantaged repackaged securities. It was a complex financial exchange facilitated in 2002 between the bank and Barclays that was considered so byzantine the judge declared that it “defies comprehension.”

The structure was created by Barclay’s and KPMG and marketed to banks like Wells Fargo among others.

The transaction involved several sub-transactions, like Wells Fargo investing in a trust held by Barclay’s who then compensated Wells Fargo, that all ended in the bank claiming foreign tax credits paid that it could deduct off of its taxes in the U.S. But the IRS balked at the bank’s attempt to claim those foreign tax credits and the case went to court.

Previously courts allowed the transaction to go through despite it being considered a “sham,” but the appeals court finally rejected the transaction altogether because it was based on economically meaningless activity solely meant to feign tax credits. Similar judgements were handed down against other banks trying something similar, including Bank of New York Mellon, BB&T and Sovereign.

The Wells Fargo subsidiaries that appear in the transaction are also in the list of thousands of subsidiaries that disappeared from the bank's SEC filings during a purge by major banks between 2008 and 2016.

Carnation Asset Management, Canopus Finance Trust, Rigil Finance, Sirius Finance, Sagebrush Asset Management, and First Security all handled the STARS transaction, and all of them disappeared from Wells Fargo's SEC filings in 2014, not long after one of the first STARS cases called the arrangement a “sham tax shelter” in 2013.

In a previous story on the subject, none of the banks nor the SEC gave an explanation as to why the subsidiaries disappeared from their filings.

Their appearance in the tax transaction may imply that the SEC limited subsidiaries to economically meaningful businesses.

Other Less Byzantine Tax Structures

While the STARS transaction may be considered unique for it's complexity, complex international tax structures are nothing new.

Structures like the Double Irish-Dutch Sandwich are used by numerous Fortune 500 companies to avoid the full burden of U.S. corporate tax rates.

Changes to U.S. corporate tax rates during the Trump administration led to an onshoring of capital, but only a partial return.

A recent report by the Dutch research group Centre for Research on Multinational Corporations (SOMO) showed that ViacomCBS uses a unique approach by licensing its content and intellectual property to third parties in places like Curaçao, Luxembourg, the Netherlands, Bermuda, and Barbados that were then merged back in to the parent company a few years later.