Despite Say-On-Pay Rules, Most Executives Are Paid More; A Few Are Paid Astronomically

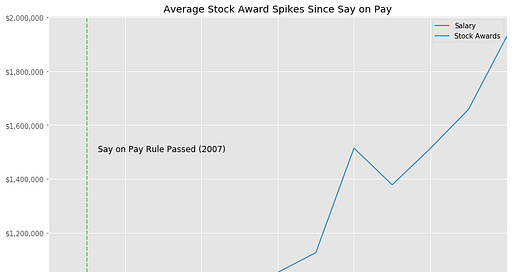

Concerns over growth in executive pay led to the passage of Say-On-Pay rules in 2007, giving shareholders a voice over how executives are paid. But rather than limiting amounts paid to corporate execs, executive pay has exploded over the last decade since the rules were passed even as Dodd-Frank rules stipulate more reporting on company pay ratio levels.

Median executive pay has increased steadily since 2009 and mean pay sharply increased immediately after the rule passed as more public companies are handing out one-time bulk payouts to executives in single-year lump sums via stock.

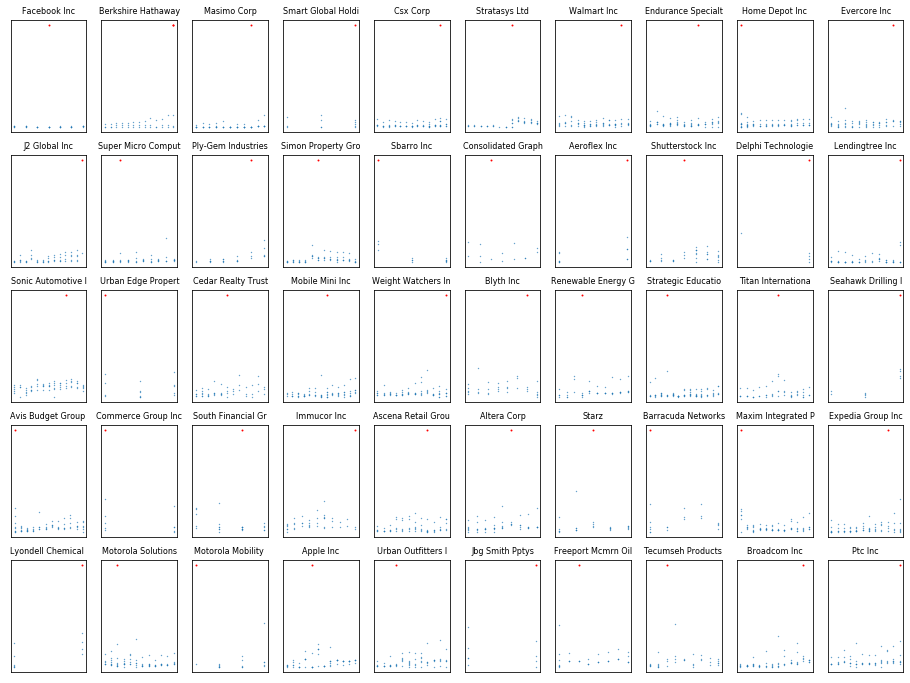

These lump sums can sometimes be ten times, even over a hundred times, the median CEO pay for that company. While there are plenty of examples of these extraordinary payments, Facebook stands apart from the rest with a $1.9 billion stock compensation package in 2014 to the Ukrainian owner of WhatsApp, Jan Koum, following Facebook's acquisition of the company.

While other large payouts may be related to company acquisitions, Security and Exchange Commission (SEC) filings show that the massive payouts are also attributed to complex performance-based pay arrangements and other contingencies where CEOs can earn tens of millions of dollars if they turn their company around or lose it all if they're fired.

Executive pay has been at the forefront of accusations against ex-Nissan CEO, Carlos Ghosn. Ghosn was lauded for turning the auto company around over the last two decades, but recent details of excess spending and potential misuse of company funds put him in the crosshairs of Japanese corporate rules and Ghosn fled the country before standing trial.

Steady Growth in Executive Pay

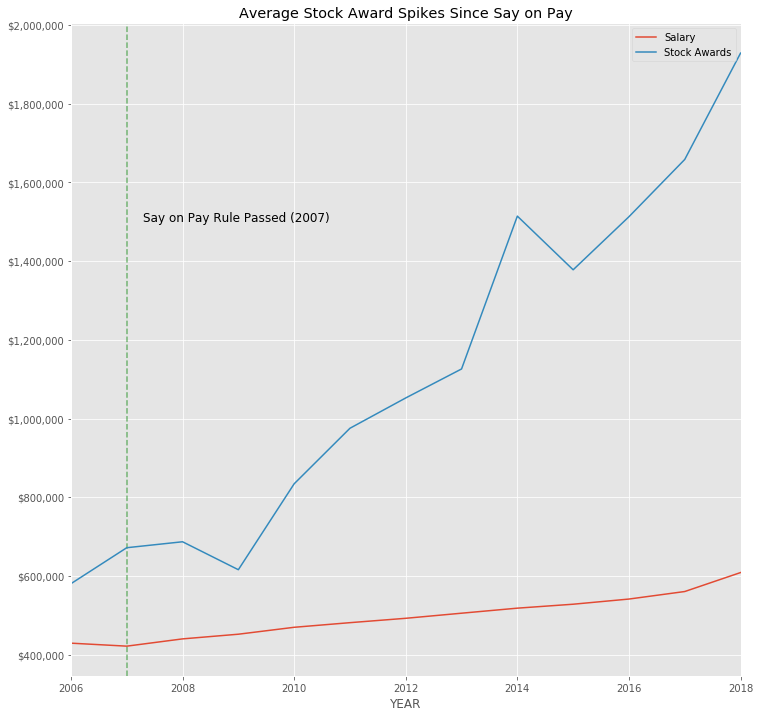

Overall, mean and median executive pay for public companies has increased since 2006, but most of that is attributable to stock-based awards. Stock-based awards went from around 11 percent of compensation in 2006 to 38 percent in 2018.

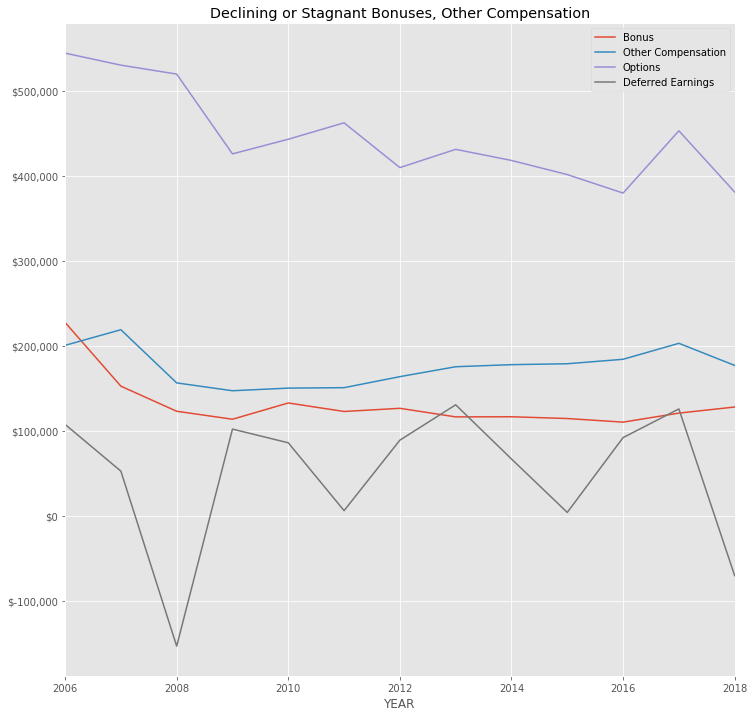

Salaries have increased as well, going from a median of $355,000/year to $518,000/year, or a 46 percent increase. Other types of compensation, like bonuses and miscellaneous benefits have been declining or flat.

Besides the outliers, the distribution of payments are relatively normal. Over 85 percent of executives make less than $5 million a year in salary, bonuses, stock and other payments. And on a per-company basis, the median compensation is less than $10 million for 99 percent of all recipients.

The same goes for directors, where the median income is only $170,000, 99 percent of recipients earn less than $650,000, and compensation is normally distributed. Since 2006, median income has increased from around $130,000 to $235,000 a year—an 82 percent increase.

Lump Sum Pay for Performance Compensation

But the discernable increase in salaries and bonuses are insignificant compared to some of the lump sum stock payments that occurred in the last two decades. The Facebook stock payment in 2014 effectively distorted the distribution of executive pay all on its own.

Facebook isn't alone. Executives at Berkshire Hathaway, Masimo, Smart Global Holdings, and dozens more all got massive payouts that dwarfed any other payment for that company. With CSX, the reason listed in SEC documents indicated was simply the liquidating of built up stock options by the long-time owner who recently passed away. For others, the reasons were more complicated and more often involved either corporate acquisitions or pay-for-performance compensation deals.

The entertainment programming company, Starz, paid out a hefty $30 million, mainly in stock options, to their CEO Christopher Albrecht in 2013 with some contingencies: the stocks were vested for a few years and he forfeits the stocks if he is fired for cause.

The Masimo Corporation gave their CEO Joe Kiani $119 million in stock options in 2015 with contingencies on how long those stocks could be vested. The company also implemented a slew of compensation agreement changes, like clawback measures and the elimination of a "poison pill" arrangement, surrounding that award.

For Marc Lore of Walmart, he received $242 million in 2017 because of the takeover of Jet.com. David Batchelder of Home Depot earned about $31 million through co-investment arrangements that were not explicitly stipulated in financial statements. David Simon of the Simon Property Group earned over $137 million in 2011 despite stockholder votes against the pay-for-performance package.

Similar for boards of directors. All in told, there were only 41 directors with income above $5 million. But within that set, the compensation was far and above the median payments received by everyone else.

Diane Green of Alphabet made over $43 million in 2016. Besides her $43 million payout in 2016, Diane Green never made more than $1.1 million in a year. She made a paltry $674,000 in 2017.

Brian Kelly of Activision made over $30 million in 2012, not as CEO, but as the number two position at the company. Besides the lump sum payment he received, his income regularly varied between $4 million in 2013 and $290,00 in 2016 otherwise.

Secretary of the Treasury Stephen Mnuchin made $11 million in 2016 while on the board of the bank CIT Group. Similar amounts paid out for CEOs of Fidelity, Valero, Regeneron, 21st Century Fox, and Weight Watchers.

Donald M. James worked for Wells Fargo for relatively normal amounts before moving to Vulcan Materials for one year to make a sudden $8 million.

Say on Pay Having Opposite Effect

Say-on-Pay Rules were passed in 2007 as a way to give investors a say on pay packages following corporate layoffs. But rather than giving shareholders a voice to limit executive pay packages, pay packages appear to only increase following 2007, dipping slightly in 2008 potentially as a result of the financial crisis.

A review of the effects of Say-On-Pay have been mixed with a 2016 review by Stanford Graduate School of Business showing that shareholder complaints about executive pay were either ineffective ("no evidence that lower shareholder support for proposed equity") and the rules either had no impact on pay levels or sometimes led to an increase in compensation.

Besides corporate acquisitions, there is little detail provided in SEC filings as to what the compensation packages go towards and why an eight-figure pay package could be justified except for general corporate performance.