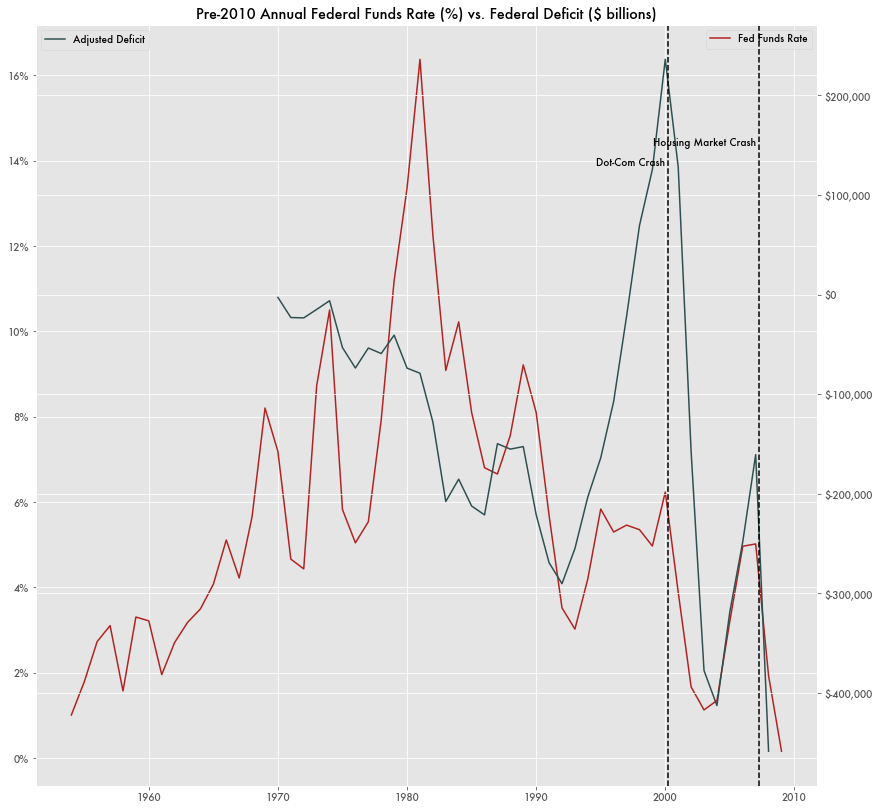

Deficit Follows Federal Funds Rate Since 1980

Over the last 40 years, the federal funds rate—the rate at which the Federal Reserve lends money—moved with the federal deficit. Sometimes it moved in lockstep.

As the federal funds rate generally declined from its historical high in the early eighties, budget deficits grew more negative through the mid-1990s.

At times the changes were almost in lockstep. When the funds rate went up, the deficit shrank. When it went back down, the deficit grew again. It did this for a few years in the late 80s, the mid-90s, and the mid-2000s during the financial crisis. (Pearson correlation .71, p-value<0.0001, fed funds volatility=.815, deficit volatility=1.69)

The switch from increasing interest rates to decreasing rates often came during economic crises. The end of increasing rates in the early 2000s coincided with the housing crash. The dot-com bust put an end to increasing rates through the 90s.

Interest rates are known to sometimes follow deficits because deficits are a source of inflation, and depending on the philosophy of the Federal Reserve at the time, the Funds rate can be adjusted alongside the deficit to make sure the amount of money in circulation in the economy (M2) keeps inflation at a reasonable rate.

But interest rates are also a way that the Treasury brings in income to pay down the deficit, and the changes could be indicative of just how substantial it is that interest rates determine budget deficits.

There are other factors at play such as additional debt held by foreign investors. And at times, the funds rate didn't change yet deficits still declined, like in the mid-90s.

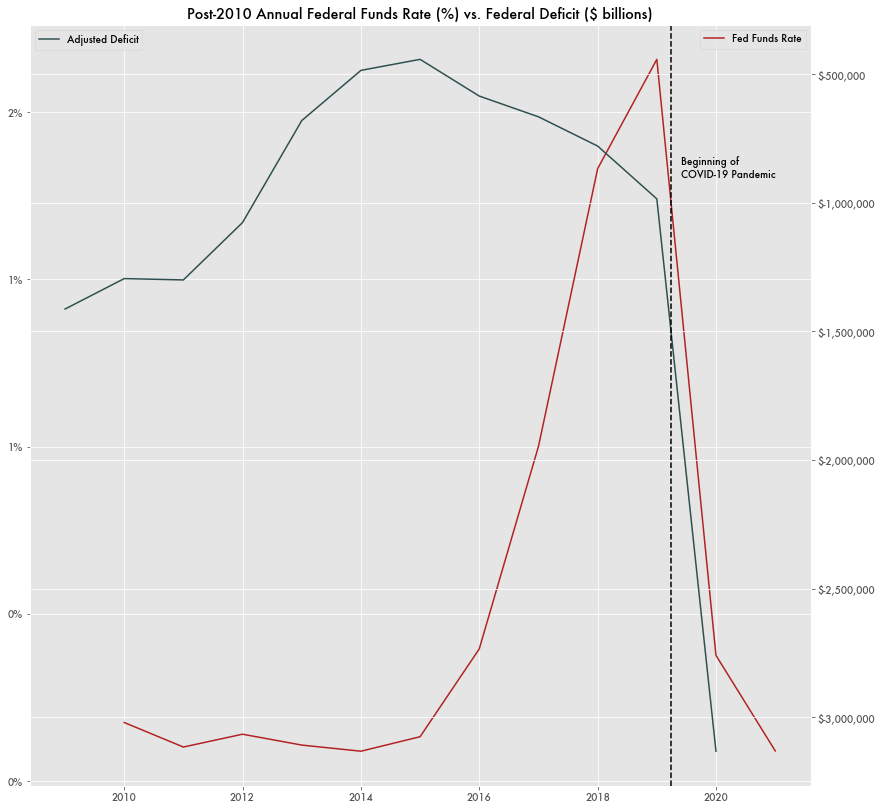

Post-2010

The trend of interest rates following deficits comes to a halt after 2010 as interest rates hit zero. They started to climb back up starting in 2016, and for a short time deficits grew rather than shrank.

That inverted trend came to a halt in 2020 as the pandemic hit and interest rates were brought back to zero again and deficits exploded to pay for the various programs to subsidize the economy, such as extended unemployment, the Paycheck Protection Program (PPP), and payments to taxpayers.

Currently the deficit is around $3.2 trillion, far higher than at any point in U.S. history even when adjusted for inflation.

In a recent forecasting report, the Congressional Budget Office (CBO) believes that federal debt will have equaled 98 percent of GDP by the end of 2020, which may lead to rising interest rates and inflation. They predicted interest rates to rise 1.3 percent from 2020 to 2025. Increased outlays would lead to increased payments to foreign investors who hold 39 percent of U.S. securities.

While increased interest rates would help pay down the debt, it will most likely lead to a contraction of the economy. In the 80s, the Federal Reserve implemented extremely high interest rates to eliminate inflation which led to a credit crunch. High rates meant borrowing money became expensive. Businesses either suffered the high costs, couldn't borrow, or turned to international lenders for capital.